Consumers consider alternative currencies when completing transactions online. Instead of using traditional payment methods, such as checking or bank accounts, they can secure their financial data by converting money to bitcoins or cryptocurrency. It is a safer way to complete transactions, and the users could acquire goods and services online by using the bitcoins.

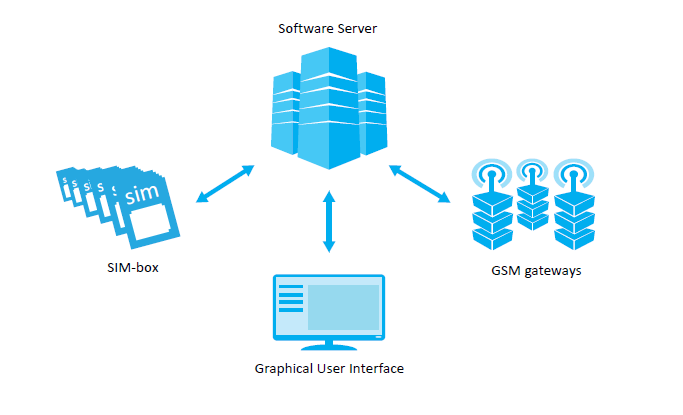

By learning more about bitcoins, they discover that the platforms are safe and secured with encryption and secured socket layers. The platforms ensure the safety and security of the user information and prevent outsiders from accessing any of their financial or confidential data.

Table of Contents

They Can Make Payments with the Bitcoin

The users can make real-time payments with their bitcoin currency, and it is used in the same way that traditional money is used online. They will need to review the accepted payments for the retailers or businesses where they want to spend the currency before starting a transaction.

All places that accept bitcoin as standard currency will honor it and enable transactions from users that are using the currency instead of direct links to the bank accounts. Consumers can learn more about making payments with bitcoin by visiting xCoins right now.

The Owner Has Control Over It

The bitcoin owner has full control over their bitcoin currency, and they can use it or convert it at any time they prefer. Many bitcoin users trade their bitcoins in hopes of making more money and improving their earning capacity. They can transfer it to different accounts or use it to purchase goods or services. The consumer won’t have to worry about others gaining access to their bitcoins or their account without proper credentials.

Minimizing Transactions Fees and Taxes

When using bitcoin instead of traditional currency, the consumers avoid larger transaction fees that apply to using credit or debit cards, checks, or other electronic payment methods. They can also avoid taxes on certain purchases and trades until the currency is switched to dollars.

By reviewing the fees and taxes for transactions, they could find better options that cut their costs and let them keep more of their bitcoins, and avoid significant financial losses because of service fees and tax implications.

Other Users Cannot See Their Financial Data

When they use their bitcoin, other users on the platforms will not see any of their financial data, and the bitcoin owners won’t have to worry about their currency getting stolen or used by other parties. It is assigned to them exclusively, and the users complete transactions with peace of mind.

They won’t have to worry about identity theft or others using the bitcoins they have in their accounts. All financial data is blocked by a secured socket layer and high-grade encryption that prevents others from decoding the financial data.

It Is Used Online Only

Bitcoin is used online only, and users can use it to complete electronic payments. Most businesses and stores will not accept bitcoins in person, and the user is restricted to online use only. However, they can transfer their bitcoin currency into US dollars to use for in-person transactions and for paying service providers. By reviewing how the bitcoins work and what payment systems use it, the consumers get full use of their bitcoin and avoid mistakes that could limit their access to goods or services they want to purchase.

Other Users See a User Name Only

When completing transactions through their account, other users will only see the person’s user name, but they won’t see any personal details about them. The encryption set up by the platform prevents access to personal details and makes it possible for bitcoin users to trade coins with other users or buy products from each other.

When completing transactions, the platform manages all details such as shipping information, contact information, and the user’s name. The strategy prevents outsiders from getting information through transactions and keeps all currency secure on the platform. The designs make it easier to keep the currency safe and prevent instances of identity theft and data loss that could prove costly for users.

They Can Use Bitcoin to Buy Stocks

When buying stocks, bitcoin is a great currency to use, and it prevents the users from relying their banking or credit card information directly. Bitcoins are available after the user transfers money to the platform and buys a specific amount of the currency. When they complete stock transactions, the buyer won’t have to worry about direct access to their banking and credit card details that could lead to financial losses and cause them to face problems later. The user receives a full portfolio of all their current stocks and can monitor their progress at any time.

The Service Provider Offers Robust Security Schemes

All security schemes are robust and comply with IT standards. The administrators for the platform evaluate the security schemes on an ongoing basis and mitigate risks to all users. The security protocol uses high-grade encryption that offers better protection than standard designs.

The administrators generate a log of all attempts to get into any account, and if there are too many failed attempts, the account is locked, and the user must contact the platform to get it unlocked. This is a security measure that stops others from using stolen information to access the bitcoin user’s account and gain access to their currency.

Consumers evaluate bitcoins as an alternative currency that will not give a direct link back to their bank accounts or credit cards. The currency is converted from US dollars when the user buys the currency and sets up their user account. The user accounts require credentials to sign in, and platform administrators monitor all accounts and transactions.

If there are any signs of fraud, the administrators act quickly to mitigate their risk and keep the bitcoins safer and secure. Consumers can use bitcoins for a variety of purchases and services. They can purchase stocks and bonds with the cryptocurrency. By learning more about bitcoins, the consumers find out better ways to conduct transactions online.